Executive Summary

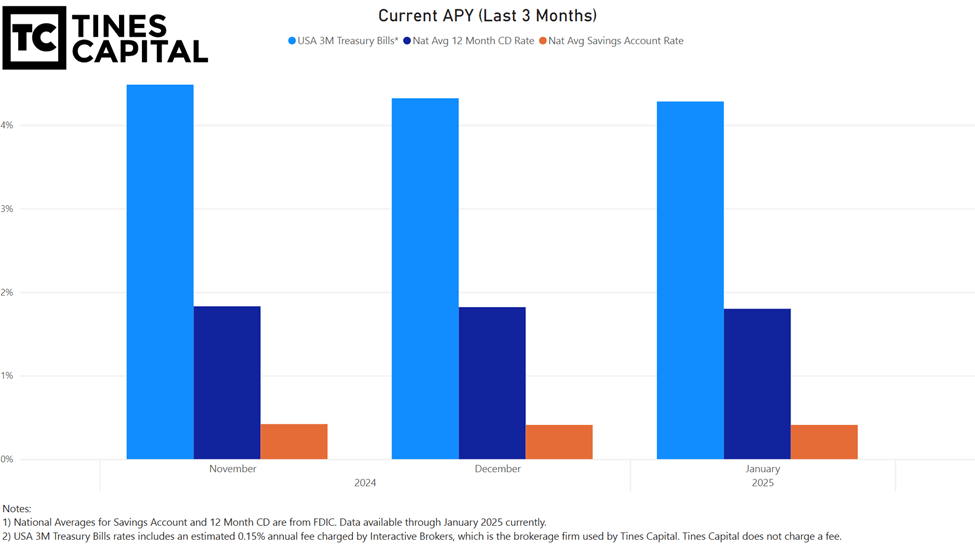

- You can typically earn more than a bank account by holding short-term U.S. Treasuries. For example, as of January they are netting over 4.1% and guaranteed by the full faith and credit of the US government. The national average 12-month CD rate is less than 2%, and the average savings account is paying less than 1%.

- Tines Capital will not charge an advisory fee to help you do this.

- Rates will change over time, but this service is designed to be competitive in any interest rate environment.

- Existing Tines Capital clients can begin by contacting their advisor.

- New clients can get started using the buttons below:

Why Your Money Shouldn’t Be In a Bank

For most of my life, I didn’t think much about the interest rates I was receiving on cash I had in the bank. My savings just sat in a bank earning next to nothing. That was normal, bank savings rates were near zero and there wasn’t much to do about it.

But that changed a few years ago when the Fed began raising rates. One day, I looked at my bank statement and realized that despite the Fed raising rates, my bank wasn’t following suit. I had earned just a few cents in interest. My Ben Franklins weren’t working for me. They were working for the bank!

I know I’m not the only one who has had that moment of frustration. If you have cash sitting in a savings account earning interest so low you need to squint to see it, you deserve a better option. We think investing in short-term US treasuries provides most people a much better option.

How Much Are Short-Term Treasuries Paying

As of this writing the FDIC has reported that the average interest on a bank savings account is only 0.41% APY. Meanwhile short-term US treasuries which are backed by the full faith and credit of the US government have a yield of 4.2% (3M US Treasuries). Yes, these are currently paying about 10 times the national average as savings accounts! These are even paying more than the average 12 month CD.

How Safe Are They?

Short-term US treasuries like the 1 and 3 month treasury bills are considered a cash equivalent and are backed by the full faith and credit of the US government. They are one of the safest investments on the planet.

How to Invest In Short-Term Treasuries on Your Own

You could set this up yourself at a brokerage firm by investing in various types of funds that buy short-term US treasuries. It isn’t that hard to go buy funds in any brokerage account. ETFs like BIL, SGOV, SHV have made it extremely easy to invest in short-term US treasuries at a very low cost in any brokerage account. But if you’d like a little more guidance and perhaps a helping hand, we’ll walk you through the process with no strings attached and we won’t charge you an advisory fee to invest in short-term US treasuries.

Use the correct button below to open an account managed by Tines Capital using our trusted custodian Interactive Brokers.

Why We’re Doing This

We’re not offering this service to make money. In fact, we won’t make a dime.

So why do it?

Anyone who knows Charlie knows he loves Costco. You’ll catch him rocking a Kirkland-branded hat, munching on Kirkland snacks, and if he’s coming over for dinner, there’s a good chance he’s bringing a bottle of Kirkland wine.

Costco’s rotisserie chicken is legendary, not because they make a fortune on it, but because it’s an incredible deal that keeps people coming back. That’s exactly how we think about our Fee-Free Cash Management service. It’s a high-value, no-nonsense financial solution designed to help you make smarter decisions with your money. And just like a Costco trip, once you see the value, we hope you’ll want to explore what else we offer.

Because here’s the thing: if you care enough to optimize your cash, at some point, you’ll care enough to optimize your investments too. And when that time comes, we’ll be here—with our straightforward approach to financial advice and our tech-savvy algorithmic investing strategies to help your money work just as hard as you do.

And maybe a Kirkland snack recommendation or two.

If you’re ready to put your cash to work, click the link below and let’s get started.

How

Bank accounts are great, for the right purpose. You need a checking account for daily spending, bills, and automatic payments. A savings account is useful for your emergency fund, cash you might need instantly if life throws a curveball.

But beyond that? Parking too much cash in a bank account long-term is a losing game:

- Inflation eats away at your purchasing power. Even if you’re earning 0.5% in a savings account, when inflation is 3%, you’re losing money in real terms.

- Banks don’t pass along competitive rates. When interest rates rise, banks take their time increasing savings yields, if they do at all.

- Better options exist. Even so-called “high-yield” savings accounts or CDs often pay less than safer, more liquid alternatives.

At Tines Capital, we believe that the best way to optimize cash that’s not needed for daily expenses is by investing in short-term U.S. Treasuries, which is debt backed by the U.S. government. These offer competitive yields, daily liquidity, and risks in line with a checking or savings account while often paying more than traditional savings accounts.

What You Get

- Higher Yield – Earn a rate that typically matches short-term U.S. Treasuries, minus fund expenses and potential small custodian fees. (We’ll provide full transparency on any potential third-party costs—no hidden fees.)

- No Lockups – Unlike CDs, your money isn’t tied up for months or years. If you need access, it’s as simple as selling Treasuries, with funds typically arriving within 3–5 business days.

- No AUM Fee – We don’t charge for this service. We believe in helping our clients make the most of their money, period.

This Won’t Make You Rich

Now the truth is most people shouldn’t have more than about 6 months of expenses invested in short-term treasuries like this. These do pay much better than a typical savings account, but they won’t make you rich. In fact they barely beat inflation in the long run.

Important Disclosures

We have the right to decline this service to anyone.

U.S. Treasury funds are not FDIC-insured, but they are backed by the U.S. government.

Treasury investments are low-risk but still subject to interest rate fluctuations.

Withdrawals require selling fund holdings, which can take a few business days.

Tines Capital does not charge a fee, but custodial fees (such as withdrawal transaction fees) may apply as do fees applied by the fund. (We’ll always disclose these upfront—no surprises.) These fees typically add up to less than 0.15% per year for an account of $10,000 and no more than 1 withdrawals per month. These fees percentages are lower for accounts with higher balances and fewer withdrawals. These can vary based on account size and transaction frequency.

We are only providing this service with no advisory fee for taxable accounts.

We recommend only doing this if you plan to keep $1,000 or more in the account.

Rates and pricing subject to change. This page is static and may not reference the current rates.

Disclaimer

Disclaimer

Tines Capital, LLC (“TC”) is a registered investment adviser in the State of Oklahoma and in other jurisdictions where exempted. The information on this website, including videos, articles, tools, and other materials, is for educational and informational purposes only. It is not intended as investment, tax, accounting, or legal advice, nor should it be relied upon as the sole basis for any financial decision.

Viewing this content, submitting information, or using any linked tools (including RightCapital) does not create an advisory relationship with TC. An advisory relationship is established only after you and TC enter into a signed written agreement.

Past performance is not indicative of future results. Investing involves risk, including possible loss of principal. TC makes no guarantees as to the accuracy, timeliness, or completeness of the information provided, which is offered “AS IS” without warranty of any kind. TC disclaims all warranties, express or implied, including but not limited to warranties of merchantability, non-infringement, and fitness for a particular purpose.

Links to third-party sites or tools are provided for convenience only. TC does not control and is not responsible for the content, security, or privacy practices of these third parties. Your use of any third-party website or tool is at your own risk and subject to its own terms and privacy policy.