I want to discuss some of my favorite ETFs, despite the losses they’ve brought me this year: SVIX, UVIX, and VXX. If you’re not a high-risk investment enthusiast, you may not have heard of these—they’re niche products. However, when used appropriately, I believe they offer a good opportunity for investors.

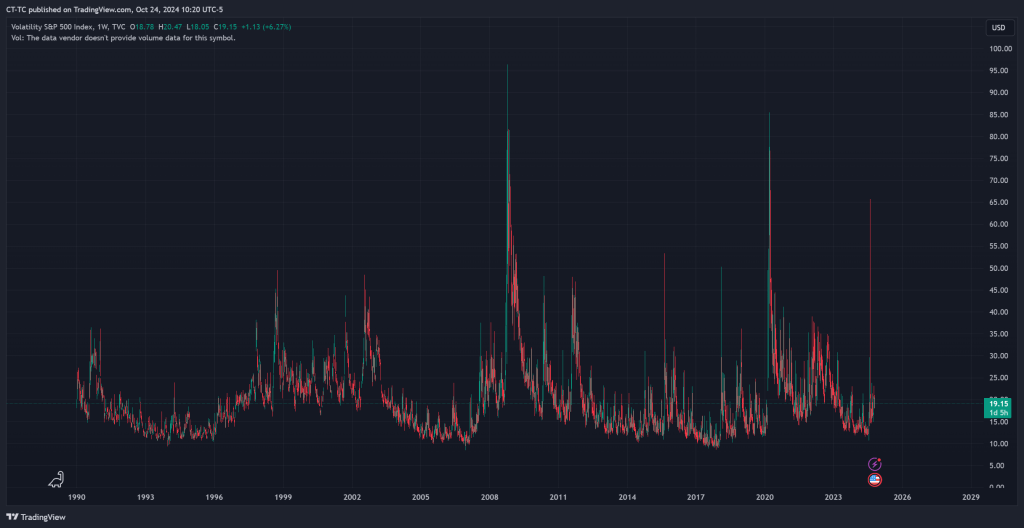

These ETFs don’t invest in stocks or bonds; instead, they buy or short VIX futures. The VIX, often referred to as the “fear gauge,” is a well-known market indicator that has been around since the 1990s. It measures how much investors expect the market to move in the next 30 days, based on the prices they’re willing to pay for options contracts on the S&P 500. When you graph the VIX from the 1990s to today, you’ll see large spikes, but it generally trends back toward the mean over time.

Investors can’t directly purchase the VIX, as it’s just a measurement. However, Wall Street has found ways to let you place a bet on almost anything, including the VIX. Investors can trade VIX futures contracts with various expirations over the next year. The ETFs I mentioned earlier—SVIX, UVIX, and VXX—buy and sell these VIX futures contracts, maintaining an average expiration of 30 days.

- SVIX shorts (sells) VIX futures with a target of -1x exposure.

- VXX goes long (buys) VIX futures with a target of 1x exposure.

- UVIX goes long (buys) VIX futures with a target of 2x exposure.

VXX is the oldest VIX futures fund available, and it’s notorious for burning cash! Here’s a chart (both log and linear) showing its performance since 2009.

Ouch! Because of this, I almost never buy VXX or UVIX. It’s very rare for me to do so, and the only time I purchase them is when my algorithms see high chances of a significant and immediate market move. Timing this correctly is challenging, but when it works, it can help save a portfolio. Of course, it can also result in significant losses when it is wrong. Over the past five years, I’ve typically held VXX or UVIX for only about 1% of the time.

If VXX is so bad, then its inverse, SVIX, must be amazing, right? Well, yes and no. SVIX aims to track the SHORTVOL index, and since SVIX is relatively new, I’ll primarily use the SHORTVOL index as a proxy for SVIX in this discussion.

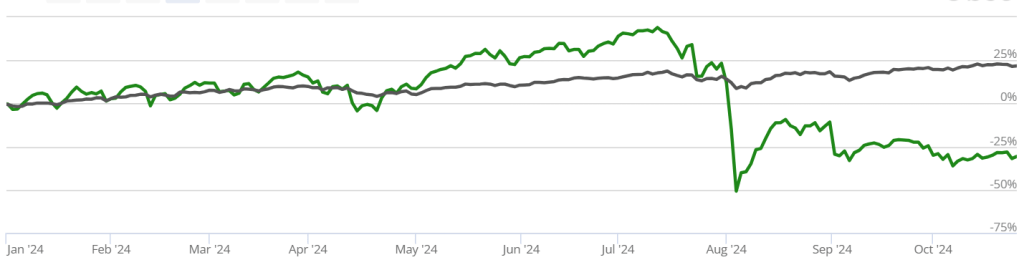

Below is a chart comparing the SHORTVOL index (green) to the SPX index (grey). Historically, SHORTVOL has delivered some monster returns! However, it also experiences some very steep and alarming drops in value. It’s not the kind of investment I could comfortably hold as a significant portion of my portfolio for the long term.

This year was one of those year where SVIX wasn’t so kind. As shown below it has done terrible.

Most of the time, I believe it’s much better to hold SVIX, but on rare occasions, it makes sense to buy VXX. Take the COVID-19 pandemic as an example. In February 2020, certain metrics I follow indicated that buying VXX was more favorable than SVIX. VXX went on to climb about 300% in the following months. That was definitely not a time to be holding SVIX, and my signals performed exceptionally well during that period.

However, there are times when market panics are enough to trigger a VXX or UVIX purchase but quickly turn out to be minor events. This year provided a great example. In August, concerns arose around the Japanese Yen carry trade—something I hadn’t worried about before August 2024, and virtually no one else had either. Suddenly, it became a big concern, but just a few days later, more data emerged, and the markets calmed down quickly. If the Japanese Yen carry scare had evolved into a major crisis, like the 2008 financial meltdown or the pandemic, the SVIX and VXX trades could have performed very well this year. However, it’s challenging for my VIX strategies to succeed when panics are extreme, brief, and ultimately inconsequential.

Trading SVIX, VXX, and UVIX is best left to professionals. I wouldn’t recommend that most people buy and sell these products on their own. Despite this subset of algorithm’s poor performance this year, there are still enough great years—like 2020,2021, and 2023—that make them worth keeping in my high-risk algorithms.

Disclaimer

Disclaimer

Tines Capital, LLC (“TC”) is a registered investment adviser in the State of Oklahoma and in other jurisdictions where exempted. The information on this website, including videos, articles, tools, and other materials, is for educational and informational purposes only. It is not intended as investment, tax, accounting, or legal advice, nor should it be relied upon as the sole basis for any financial decision.

Viewing this content, submitting information, or using any linked tools (including RightCapital) does not create an advisory relationship with TC. An advisory relationship is established only after you and TC enter into a signed written agreement.

Past performance is not indicative of future results. Investing involves risk, including possible loss of principal. TC makes no guarantees as to the accuracy, timeliness, or completeness of the information provided, which is offered “AS IS” without warranty of any kind. TC disclaims all warranties, express or implied, including but not limited to warranties of merchantability, non-infringement, and fitness for a particular purpose.

Links to third-party sites or tools are provided for convenience only. TC does not control and is not responsible for the content, security, or privacy practices of these third parties. Your use of any third-party website or tool is at your own risk and subject to its own terms and privacy policy.